Islamic Banking

MALAYSIA pioneering and leading the world in Islamic Finance providing Muslims and all mankind the way out from the biggest sin of 'riba' and the war of Allah to those who are engaging in giving or taking or providing services in any kind of activities involving 'riba'. It is our obligations without any choice, to migrate totally from activities of 'riba' to non- 'riba'.

Banking and Insurance are the main activities in business as well as in our daily life. In early 1960s we never heard of Islamic Bank or Islamic Insurance and we were exposed to interest banking or financial system, which we had no other choice but to involve in these un-Islamic activities. Muslim is strictly prohibited to take , give, and providing activities relating to 'riba' as clearly stated by Allah in the Quran Surah 2:275

As a Muslims we have to avoid ourselves from activities which involve 'riba' or interest. This is because 'riba' is one of the biggest sin and the only sin that Allah declares war on those involve in taking or giving or providing services in 'riba', as clear stated in the Last Testament, the Holy Quran in Surah 2:279.

Muslim Management experts from Malaysia formulated the first Islamic Financial System by introducing an Islamic Financial Institution known as Lembaga Tabung Haji Malaysia [Haj Fund Board] [TH]in 1963, and later introduced Bank Islam Malaysia in 1983 to the business activities. Indeed Malaysia is pioneering and leading the world in implementing Shariah Management in Finance.

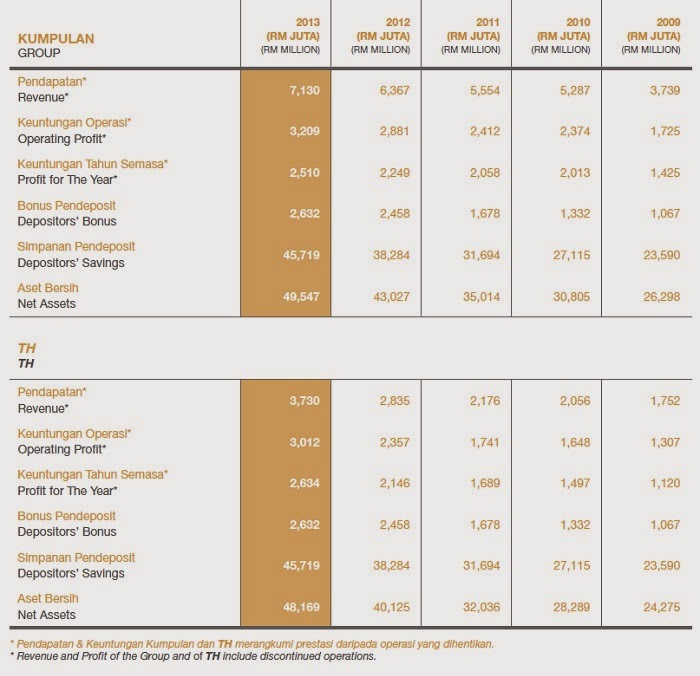

Today TH has grown into an Islamic Financial Power House in Malaysia with Group asset of RM 49.5 billion or USD 16.5 billion, in 2013, The investments of TH, which are all strictly according to Shariah, are spreading all over the world. The financial detail of TH Group is shown in the following table:

The development of Islamic Management in Finance which is in conforming to Shariah [Islamic Laws] is very encouraging and being accepted by all Muslims and Non-Muslims alike. In 2013. Malaysia leading the world by issuing the biggest amount of Suku [Islamic Bonds] a total of USD 37 billion which was 63% of the suku issued all over the world, followed by Saudi Arabia USD 9.3 billion, United Arab Emirate [UAE] USD 5.2 billion , Indonesia USD 2.8 billion, and all other countries, USD 4.7 billion,

Today Islamic Management in Finance plays a very important role in all field of business activities as well in our lifestyle all over the world, The United Kingdom Islamic Finance Reported that currently in 2014, Global Islamic Asset is estimated to be USD 2.0 trillion.

Islamic Finance provides Muslims and all mankind the way out from the biggest sin of 'riba' and the war of Allah to those who are engaging in giving or taking or providing services in any kind of activities involving 'riba'. It is our obligations therefor, without any choice, to migrate totally from activities of 'riba' to non- 'riba'.

Malaysia still leading the world of developing Islamic Management in Finance. According to the latest Islamic Finance Development indicators Ranking, Malaysia remain the the Top No 1 of the top 10, with 93 points, followed by Bahrain 76 points, Oman 64 points , United Arab Emirates 57 points, and the last bottom in the ranking is the Saudi Arabia 31 points and followed by Brunei 29 points.